Let's Connect fastest growing future tech web 3.0 blockchain group to connect & share with same minded people

Use Case of Blockchain – Income Tax System in India

Blockchain

Blockchain

Hello Everyone,

For many days I was thinking about blockchain at which other places it can be implemented. Before we even think of it, there are certain criterias to use blockchain technology in any area or not.

One of the areas where I am thinking of probable use of blockchain technology is the “Income Tax Ecosystem” of India.

Now before you or any of your team make or come to any conclusion, then I would suggest going through the whole blog then try to comment on it.

This will be a very high level draft version of paper on using blockchain in the Income Tax Ecosystem of India and only applied to salaried professionals. The blockchain technology that can be used or probably used is R3 Corda Blockchain.

Problem Statement

So, what happens in India for a professional when his/her fiscal year starts from April month, we need to project our investments and start showing our investment and on that basis tax is deducted by the employer (legally bound) and submitted to the government. However, until you show any investment your tax amount would increase based on your income on a monthly basis. Once you show investment, the tax deduction amount is decreased.

What is the issue here ?

Once again reiterating, that if you submit the proof of investment then your tax deduction amount is decreased. Coming straight to the point, if your investment proof is enough to claim the already deducted tax earlier, then currently there is no provision to get it back in the same day or month or even in the same fiscal year.

For example,

Raju has 8 Lacs per annum salary and is working for X company. Now, he didn’t start any investment until July month of the fiscal year. His Y amount is deducted every month till July month, so that total tax amount deducted is 4Y. On 1st August, he submits investment proof so that he should get at least 1Y to his account. But no, he has to wait until next year after he gets his Form 16 and submits to Income Tax portal and then wait for some days and get a return of 1Y.

Don’t you think Raju should get 1Y immediately on the same day or next day?

Solution

We will talk about solutions in all the terminology of R3 Corda Blockchain Platform. A few points to mention about R3 Corda Blockchain as below

- The participants communicate with each other on need to know basis

- Legal Prose Contract means to consult if there any conflicts arise while verifying the transaction.

Click here, to read more about R3 Corda blockchain.

The solution about Raju claiming for 1Y amount should be real-time means should get on the same or next day.

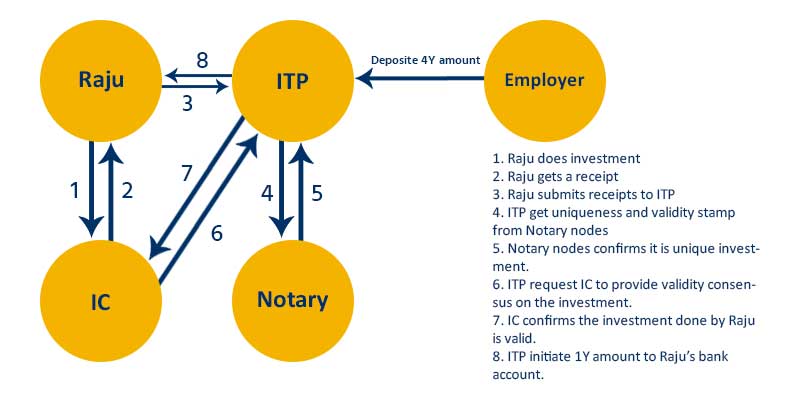

The below steps should be followed to claim 1Y amount by Raju.

- 4Y amount was deducted by the employee and submitted to the Income Tax government.

- Raju does the investment and gets the receipt of the same from the investment company. We are not categorising further into tax code whether it is 80C, 80D, 1010, etc.

- On the same day, Raju will submit the receipt on Income Tax portal (ITP).

- ITP sends the investment proof to Notary (notary or counterparty that confirms about uniqueness (means no double spending).

- Then ITP will get it verified by the document from the investment company (IC). The IC needs to verify the investment document whether it is valid or not.

- IC should give go ahead to ITP if all the parameters and inputs match as per the valid transaction made by Raju.

- Finally, ITP will recalculate the Tax deducted at Source (TDS) and initiate the transaction to refund the amount to Raju on the same day or other day.

- Once Raju receives the amount, again an acknowledgement goes to ITP about the same.

Let’s understand more with the help of a diagram.

I hope you are able to understand what I am trying to explain here. There are few things that will be resolved.

- The Income Tax department will have each valid investment from an individual.

- Real Time tax amount claimed by the taxpayer will get deposited in his/her account.

- More transparency between taxpayer, employee and Income Tax.

- Taxpayer can only claim for valid investment.

- No wastage of time by taxpayer to file the return by so and so date.

- Half of the resources of the Income Tax department will get rid of manual work or partial automated work.

Many more points can be added, but again to keep this short and sweet, we will now come to the conclusion part.

Moreover, the whole system could be automated by omitting the 2nd step in the above diagram and instead of Raju, IC will submit the investment proof to ITP. We can put all our burden of claiming tax amount on blockchain technology and thinking more on investments.

Please comment your thoughts on this blog on linkedIn or here below. This will encourage me to write more blogs on such and more topics.

Author Name : Kiran Sagar